Opinion on Wall Street

Lack of female-led ‘unicorns’ shows the need for change in the VC world

Women continue to receive only a small fraction of funding from firms

By Anna Mutoh, published: Financial Times, Mar 8, 2024

Aileen Lee, who coined the term, ‘unicorn’ 10 years ago © David Paul Morris/Bloomberg

Earlier this year, venture capitalist Aileen Lee, who coined the term, “unicorn” for privately held start-up companies valued at $1bn or more, put out a report reflecting on what had changed in the 10 years since the moniker was created.

A lot certainly had changed — the number of unicorns in the US grew from 39 to 532 in the past decade, while one notable start-up, Meta, has reached a $1.3tn market capitalisation. But one thing stayed the same says Lee: the lack of female founders of companies.

There has been some slow improvement, but only to still low levels — just 14 per cent of unicorns have a female co-founder, up from 5 per cent a decade earlier. And only 5 per cent have a female founding chief executive, up from zero over the same time. As Lee, herself a founder of the Palo Alto-based VC firm Cowboy Ventures, points out: “There are more founders named Michael, David and Andrew than there are women unicorn CEOs.”

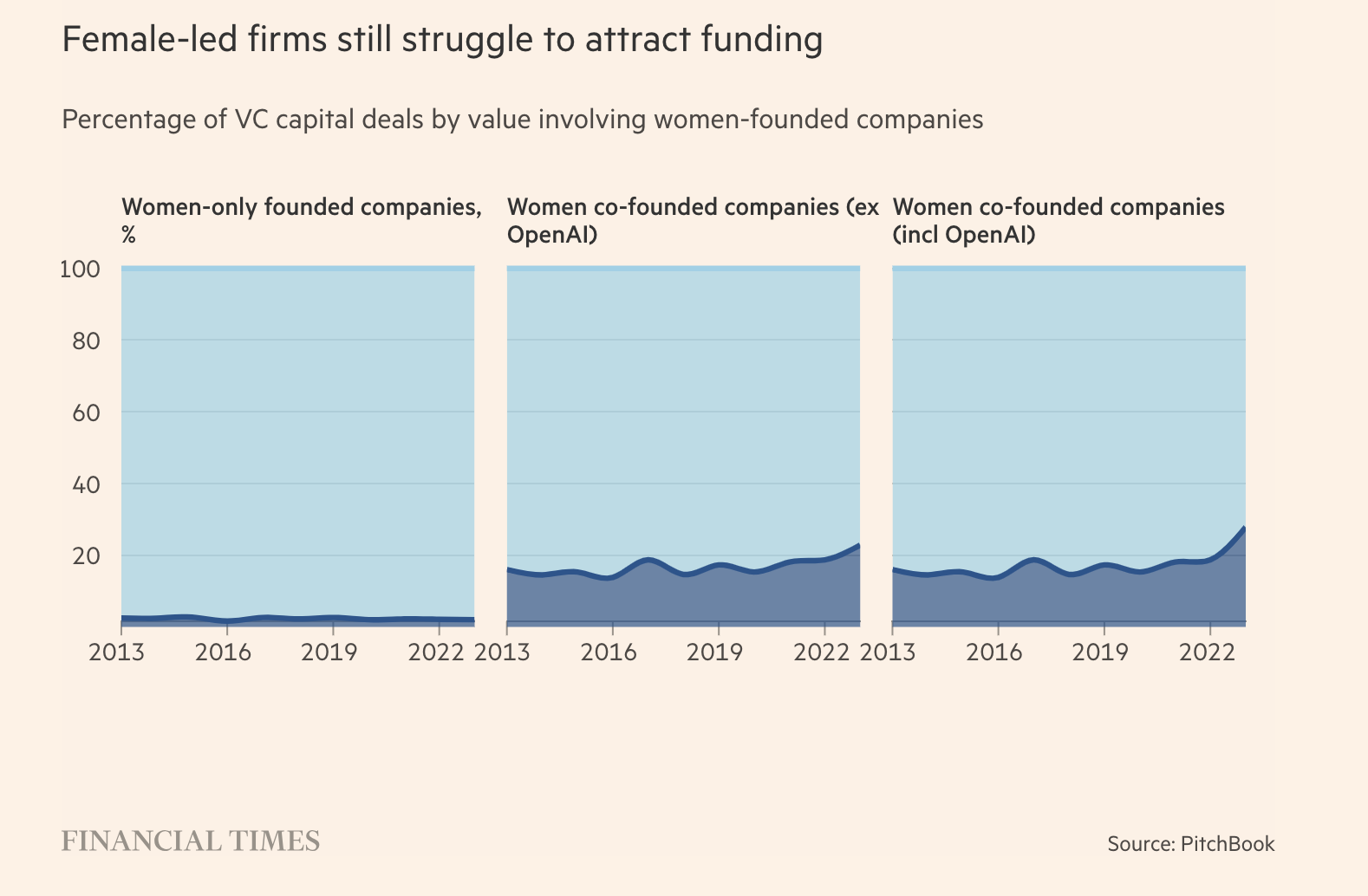

The imbalance is reflected in investment flows. The share of funding for companies with women-only founders declined from 2.5 per cent of all venture funding in 2013 to 2 per cent last year, according to data provider PitchBook.

The picture was better for those with at least one female co-founder. Their share of VC funding deals by value rose from 16 per cent in 2013 to all-time high last year of 27.8 per cent, says PitchBook. That figure was partly skewed though by the outsized $10bn fundraising of OpenAI which had two female co-founders. Excluding the Sam Altman-led company, the share dropped to 22.8 per cent.

There is one glaring factor behind the imbalance. Some 85 per cent of the writers of cheques for VC investments are men, according to the non-profit group All Raise and Crunchbase. Heather Gates of Deloitte & Touche points out that among investment partners, women are also far less likely to represent their VC firm on the boards of portfolio companies or serve as a member of the firm’s investment committee. The lack of female representation can lead to obvious biases. Alison Greenberg, co-founder of Ruth Health, a virtual maternity care provider, says a male investor once told her that “pregnancy is niche” and opted not to invest.

Such decisions could represent a missed opportunity. A recent survey by Boston Consulting Group of 350 start-ups found businesses founded by women ultimately deliver higher revenue — more than twice as much per dollar invested — than those founded by men. Female founders also burn through cash at a slower pace and exit sooner at a higher rate than male founders, according to PitchBook.

The BCG survey posited some ideas about the reasons for the shortfall in funding for female entrepreneurs. “One, more than men, women founders and their presentations are subject to challenges and pushback. For example, more women report being asked during their presentations to establish that they understand basic technical knowledge. And often, investors simply presume that the women founders don’t have that knowledge,” it says. BCG adds if a potential funder makes negative comments about aspects of a woman’s pitch she is more likely than a man to accept it as legitimate feedback rather than contest it.

BCG says male founders are more likely to make bold projections and assumptions in their pitches. “One investor told us, ‘Men often overpitch and oversell.’ Women, by contrast, are generally more conservative in their projections and may simply be asking for less than men,” it says. “In general, women often come up with ideas that they have experience with,” one investor said. “That’s less true with men.”

Many male investors have little familiarity with the products and services that women-founded businesses market to other women. “This presents an arbitrage opportunity,” said Andrea Turner Moffitt, founder of Future Heights Ventures and co-founder of another VC firm, Plum Alley Investments. One example of that is women’s healthcare. “Less than 2 per cent of VC funding goes into women’s health. There is a mismatch,” says Naseem Sayani, co-founder of Emmeline Ventures.

Consumer-oriented companies also tend to have a better pathway for female founders who can readily tap into the consumer experience, says Allison Baum Gates, general partner at SemperVirens Venture Capital.

One source of hope for female entrepreneurs is greater representation of women within VC firms. Deloitte’s Gates says 35 per cent of junior level investment positions were female in 2022, up from 25 per cent in 2016. As they rise up the ranks, they might be more inclined to back the female-led unicorns of the future.